The Top 5 Stock Brokers in Malaysia

Wealthy people are known to have mastered the art of leverage using their money. So, they usually have more passive income sources than active ones.

If you’re aiming to build your finances, buying and trading shares from a company are one of the best ways to start.

To help you get started in your journey to financial freedom, we compiled a list of the top stock brokers in Malaysia! With these reliable options, you can buy and sell stocks without consuming all of your working time in a day!

How much do stock broker services cost in Malaysia?

Stock brokerage can be traditional or done online. Traditional brokerage is when you let a firm or investment bank do the trading for you, but it comes with a premium fee for their service.

Online brokerage platforms, on the other hand, let you trade and invest on your own and may have cheaper charges. Nevertheless, fees are calculated based on the percentage of your investment, and to give you an insight, here’s their average cost:

1. HLeBroking (Hong Leong Investment Bank)

| CRITERIA | RATING |

| Qualifications | ★★★★★ (5/5) |

| Rates (A higher score means the company offers better and consistent rates for all services) | ★★★★☆ (4/5) |

| Accessibility | ★★★★★ (5/5) |

| Customer Support | ★★★★★ (5/5) |

| Phone Support | ★★★★★ (5/5) |

| Online Support | ★★★★★ (5/5) |

We like that HLeBroking from Hong Leong Investment Bank seeks to assist customers in making trading and investment strategies. Their brokerage fee starts at 0.0848%, significantly lower than the average price in the market.

With them, we appreciate that investors can trade stocks in Malaysia and countries like the US, UK, Hong Kong, Shanghai, Australia, and Thailand.

What’s great about HLeBorking is one can avail of their services without a monthly subscription and service fee.

Aside from stockbroking, they also have investment banking services, including equity funding, private debt securities (PDS) issuances, loans, IPO, and more.

We think that this will be helpful for those who are just starting their careers but also aim to build their wealth.

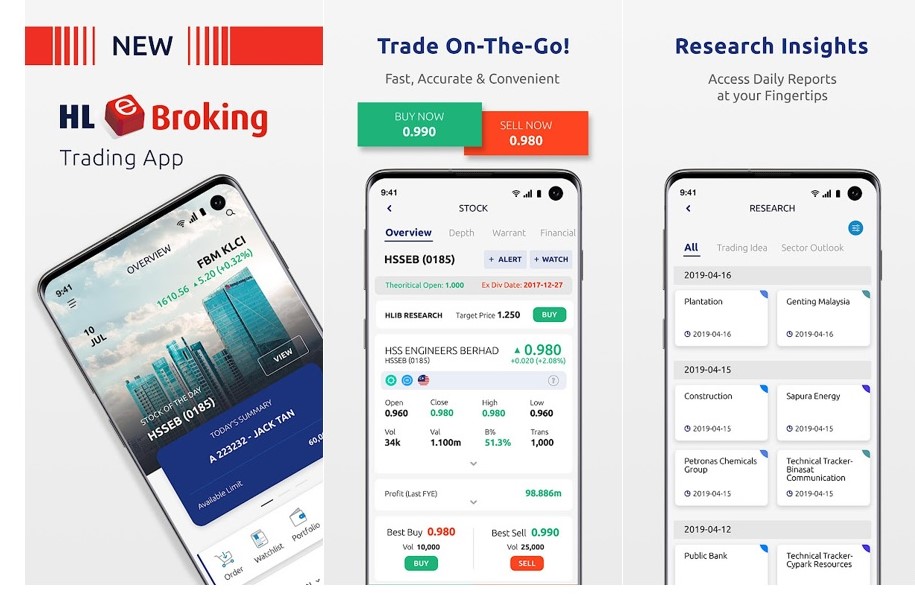

Their team of professional dealers is ready to assist through their trading hub. However, we like that if an investor prefers to trade on their own, they can open an online account that they can access using smartphones.

We were just a bit iffy that there is no biometrics log-in for their mobile application, which can cause security concerns for some. Additionally, we also learned that they offer higher brokerage rates for transactions done through the app.

Finally, we’re very particular about online security, so we’re glad to know HLeBroking offers 128-bit SSL encryption. This secures your data and the authenticity of the website you’re on to protect your account information from possible theft.

Pros

- Complete online trading tools

- Online account application available

- Mobile app available on Android, iOS, and HarmonyOS

- Low brokerage fee

Cons

- Different brokerage rate for phone orders and online orders

- No biometrics login available for the app

2. UTrade by UOB Kay Hian

| CRITERIA | RATING |

| Qualifications | ★★★★★ (5/5) |

| Rates (A higher score means the company offers better and consistent rates for all services) | ★★★★★ (5/5) |

| Accessibility | ★★★☆☆ (3/5) |

| Customer Support | ★★★★☆ (4.5/5) |

| Phone Support | ★★★★★ (5/5) |

| Online Support | ★★★★☆ (4/5) |

UTrade by UOB Kay Hian stood out to us because they are one of Asia’s largest brokerage firms. In addition, they’re based in Singapore, the hub of Southeast Asian trade.

We were impressed to learn that they have over 80 branches all over the world!

As for those starting as an investor, the greatest tool is information on the latest stock market practices, which is why we think UTrade is an excellent option.

Notably, UOB Kay Hian’s UTrade doesn’t only have the platform that enables you to put your money in the right place, but they also conduct seminars and provide research tools for their clients.

Their trading products are equities, foreign trading, exchange-traded funds (ETFs), structured warrants, and custodian services, which are also impressively broad.

For their trading services, we like that they offer extensive options, such as corporate and financial advisory, acquisition finance, investor education, structured financing, wealth management, and margin trading, as well as retail and institutional investors.

Moreover, we think it’s great that their research team and award-winning analysts devised all these trading products and services.

This research is conducted to help clients understand the confusing world of trading as they avail its trading products and services.

Unfortunately, we gathered that they are only operational in four countries: Singapore, Hongkong, Malaysia, and the USA, unlike other providers with a bigger scope.

They also don’t have a mobile application available in Malaysia — which was a letdown if you ask us.

Pros

- Offers trade seminars for clients

- Comprehensive range of research tools

- Wide range of trading options

- Products and services are backed by award-winning analysts

Cons

- No app available in Malaysia

- Limited to four stock markets only: SG, HK, MY, and US

3. Affin Hwang Investment Bank Berhad

| CRITERIA | RATING |

| Qualifications | ★★★★★ (5/5) |

| Rates (A higher score means the company offers better and consistent rates for all services) | ★★★★★ (5/5) |

| Accessibility | ★★★★☆ (4/5) |

| Customer Support | ★★★★★ (5/5) |

| Phone Support | ★★★★★ (5/5) |

| Online Support | ★★★★★ (5/5) |

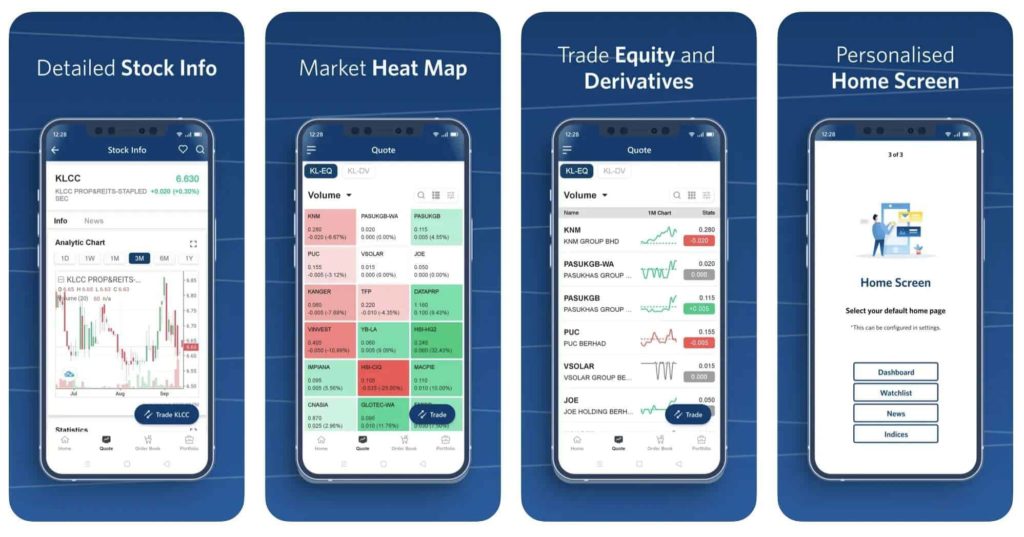

Affin Hwang Investment Bank Berhad is a specialist Malaysian bank that focuses on providing investment opportunities.

We learned that they recently released eInvest Go, an online account opening service that clients can view and manage their investments from their personal devices — a plus for convenience!

We think that their online service is safe, secure, and easy to use, especially for those who would rather avoid face-to-face transactions.

It’s also noteworthy that they’re facilitated by an e-KYC solution, so that account activations take only a day, which is perfect for those who can’t wait to start!

We think it’s commendable that this platform gives customers everything they need to get kickstarted in their investment journey.

In addition, Affin Hwang Investment Bank Berhad offers educational materials, information on the latest news, and extensive research on the market structure.

We’re impressed that the actual trading processes couldn’t be easier with the full range of live trading functions, price quotes, premium stocker screeners, personalized products and services, and the price quotes displayed.

We also like that there’s a bonus for those who use eInvest Go brokerage from a minimum of RM 5 per trade.

The only downside is that one must have an Affin Hwang Bank Berhad bank account before investing. Additionally, the funds are available only in Malaysia, which limits their accessibility for us.

Pros

- eInvest Go app available on Android and iOS

- Online account opening service

- Complete range of financial advisory services

- Multi-awarded investment firm

Cons

- Funds are only offered to those in Malaysia

- Must be a client of Affin Hwang Bank Berhad to open an account

4. Mercury Securities

| CRITERIA | RATING |

| Qualifications | ★★★★★ (5/5) |

| Rates (A higher score means the company offers better and consistent rates for all services) | ★★★★★ (5/5) |

| Accessibility | ★★★★☆ (4/5) |

| Customer Support | ★★★★★ (5/5) |

| Phone Support | ★★★★★ (5/5) |

| Online Support | ★★★★★ (5/5) |

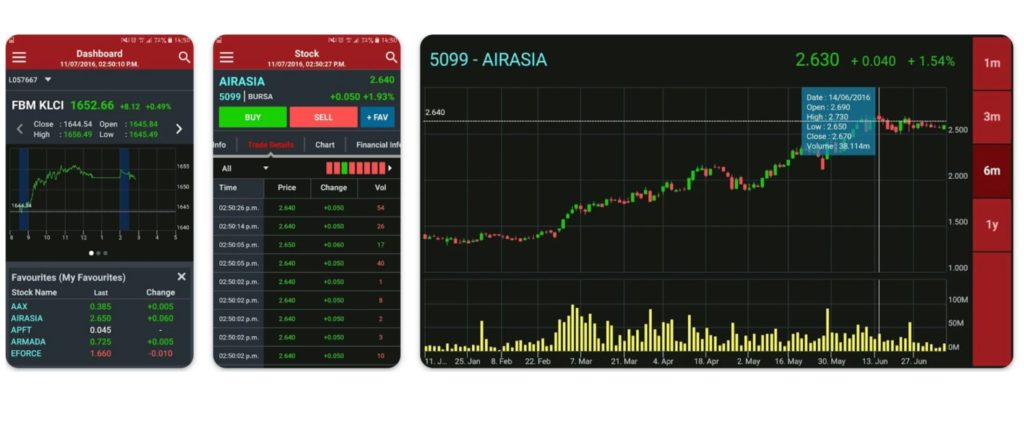

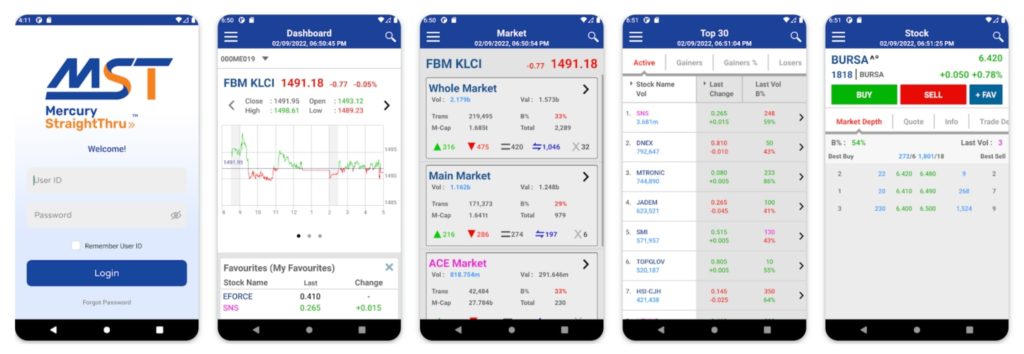

Mercury Securities’ stood out to us because they are a Malaysian stockbroking firm that’s been in the financial business since 1992.

We learned that Mercury Securities aims to make trading Bursa Stocks easy for everyone, regardless of their knowledge and experience with trading stocks.

To achieve this, they developed an easy-to-use application available on Android and iOS devices: Mercury StraightThru. On this accurate and efficient app, customers can fully manage their trading accounts in real time with the promise of anonymity.

In our books, this app is excellent since it gives users the ability to place trades at any time of the day. However, trades are only executed during trading hours.

It’s also a plus that, as long as orders and trades are still unmatched, customers can delete or amend them. Another feature we found notable is that users can also create a portfolio for all their favorite stocks to keep a watchful eye on them.

With their help, customers can receive stock recommendations for all risk levels and equity strategies. We like that investors also develop a clearer outlook on the economy and market, which is vital in understanding how trading works.

We commend them since their team consists of highly dedicated individuals whose only job is researching and analyzing companies, industry fundamentals, and the economy. For us, this expertise helps their clients make the best investment decisions.

However, keep in mind that their trading markets are limited to Bursa Malaysia, New York Stock Exchange, London Stock Exchange, and Hong Kong Hang Seng.

Pros

- App available on Android and iOS

- Online application for trading account

- Economic and market research is available on their website

Cons

- Limited to 4 stock exchange markets

- No after-hours trading

5. PM Securities Sdn Bhd

| CRITERIA | RATING |

| Qualifications | ★★★★★ (5/5) |

| Rates (A higher score means the company offers better and consistent rates for all services) | ★★★★★ (5/5) |

| Accessibility | ★★★★☆ (4/5) |

| Customer Support | ★★★★★ (5/5) |

| Phone Support | ★★★★★ (5/5) |

| Online Support | ★★★★★ (5/5) |

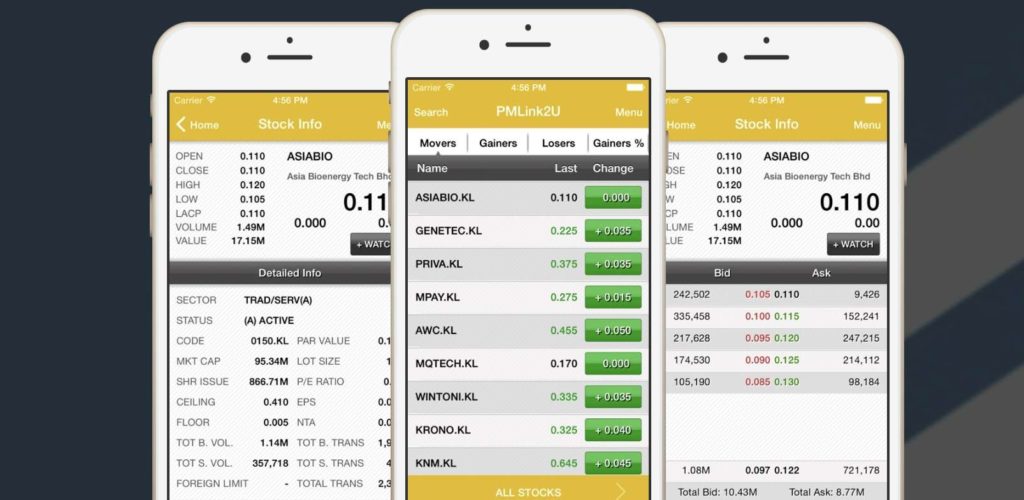

Since they established their company in 1972, PM Securities has serviced hundreds of individuals and companies with their financial matters.

While they offer multiple services, we’ll focus on their retail share trading, institutional share trading, and foreign share trading.

Their retail share trading is for individuals, and they offer two methods: traditional and online, which is pretty standard these days.

But we recommend using PM Securities’ online trading for people who prefer executing their trades independently — and the brokerage rates are better!

On the other hand, those who need more guidance in trading would benefit from the traditional method, as a representative will assist customers on this matter.

Another notable difference between the two trading modes is that those who choose the online trading method can place their trades outside business hours. In contrast, those using the traditional method are limited to placing trades during business hours.

As for their institutional share trading, we think it’s great for corporate clients needing specific, comprehensive, and timely support. Based on our surveys, many clients commended their good workflow and straightforward processing of trades.

With their foreign trade sharing, we like that customers can access over 15 equity trade markets worldwide, making their trade and stock portfolios extremely diverse.

Just keep in mind that they will require a Central Depository Account before customers can start trading. Furthermore, they only permit one trading account per customer.

Pros

- Application available on Android and iOS

- Posts up-to-date research and news regarding the economic markets

- Provides comprehensive trading guide on the website

- Has over 15 equity trade markets

Cons

- Requires a Central Depository Account

- Only one trading account per person is permitted

Comparison of Stock Brokers in Malaysia

FAQs about Stock Brokers in Malaysia

Stocks, investments, and finances are something everyone should learn, but for some reason, we just don’t. That’s why we’re glad you made it to the end of this article and have increased your knowledge of the best stock brokers in Malaysia!

There are still a lot of brokerage companies across Malaysia, so if you know one that’s on this list, don’t hesitate to let us know! We’re always excited to hear back from you. That’s why we’ll make sure to go through your suggestions one by one!

Before you go, we have an article on the best digital banks in Malaysia that you might need one day!