5 Banks That Offer the Best Car Loan in Malaysia

Are you planning to buy your own car but aren’t sure if you can afford it? You don’t have to empty your bank account and spend all your savings if you can get the best car loan in Malaysia.

There are a lot of things to consider before applying for a car loan, like the interest rate, your credit score, the loan term, repayment time, and other financial factors. Luckily, we’ve listed down the best car loans in Malaysia that offer the best deals that are easy to apply for.

The Best Car Loans in Malaysia

Though paying in cash is the best way to avoid interest rates from borrowing, we don’t always have enough money on hand to buy a car. To help you buy your dream car, we’ve prepared a detailed review of the best car loans in Malaysia.

Our team spent hours comparing market prices, interest rates, repayment plans and calculating their prices to give you the best recommendations possible. So whether you’re a fresh graduate or a business owner, you can find the perfect auto loan for your needs right here.

1. RHB’s Auto Financing

| WEBSITE | rhbgroup.com |

| SERVICES | Car loan, auto insurance |

| ADDRESS | 19, Jalan Besar, 34350 Kuala Kurau, Perak |

| CONTACT INFORMATION | Email: customer.service@rhbgroup.com Contact Number: +603-9206 8118 |

| REPAYMENT CHANNELS | Internet banking, interbank GIRO, standing instructions, cash deposit machines, ATM, cheque deposit terminals, and more |

| ELIGIBILITY | Minimum Monthly Salary: RM2,000 Minimum Annual Income: RM24,000 Minimum Age: 18 years old Maximum Age: 70 years old Guarantor requirement: Applicants below 21 years old, above 60 years old, or foreigners |

Are you looking for low monthly payments for new or used cars? RHB offers a flexible auto financing plan that caters to brand-new cars or reconditioned vehicles at affordable terms.

Unlike most car loans, this one is open to applicants as young as 18 years old as long as they can meet the repayment terms. They also have simple document requirements that you can easily review on their website.

As long as you have an annual income of RM24,000 and you’re above 18 years old, you should have no problems applying for this loan. For a typical 7-year loan period, their interest rate can go as low as 3.75% with a monthly payment of RM488.

You can expect fast approvals and hassle-free processing as long as you have all the requirements checked out. Whatsmore, you can easily find everything you need on their website and you can apply for the loan online whenever you’re ready which is very convenient.

Pros

- Fast approval

- Flexible financing period

- Easy monthly repayment

- Comprehensive auto insurance

Cons

- Requires a guarantor for applicants below 21 years old, foreigners, or above 60 years

- Non-Malaysian applicants need a warrantor

- Limited loan packages

2. Maybank Hire Purchase Loans

| WEBSITE | maybank2u.com.my |

| SERVICES | My First Car Plan, Murabaha Vehicle Term Financing, Hire Purchase, Takaful Auto Credit Plan |

| ADDRESS | Malayan Banking Berhad, Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur, Malaysia |

| CONTACT INFORMATION | Email: mgcc@maybank.com.my Contact Number: 1-300 88 6688, +603 2070 8833 (head office) |

| REPAYMENT CHANNELS | M2U, ATM, CDM |

| ELIGIBILITY | Minimum Monthly Salary: RM2,500 Minimum Annual Income: RM30,000 Minimum Age: 18 – 21 (depending on the loan package) Maximum Age: 60 Guarantor requirement: Applicants below 21 years old or foreigners |

If you’re looking for different loan options to choose from, Maybank has the loan packages for you. They have 4 different auto loans that cater to first-time car owners, Islam applicants, and hire purchase plans for new and secondhand vehicles.

They have convenient car loans for employed graduates and undergraduates that you won’t find in other banks. If you’re aged between 20 to 30, you can practically get a loan as long as you have a degree, a monthly salary of RM2,500, and at least 6 months of employment.

Undergraduates from 18 to 30 years old can also get a loan as long as they’re pursuing a degree of higher learning and have a direct relative who can serve as their guarantor. These loan packages are targeted at professionals like government workers, teachers, nurses, accountants, engineers, doctors, and lawyers to name a few.

They also have the Murabahah vehicle term and Takaful auto credit plan for Islamic car financing customers. Applicants can enjoy a flexible financing margin, comprehensive takaful coverage, fast approvals, 9 years tenure of financing, and rebate for early settlements.

Pros

- Multiple car loan packages

- Murabahah and Takaful coverage

- Affordable repayment plans

- Fast processing and approvals

Cons

- No cheque repayment option

- No online car loan application

- Requires a direct relative for a guarantor

3. Hong Leong Bank Auto Loan

| WEBSITE | hlb.com.my |

| SERVICES | Auto loan |

| ADDRESS | Ground Floor(Lot G3), Menara Raja Laut No, 288, Jln Raja Laut, 50350 Kuala Lumpur, Malaysia |

| CONTACT INFORMATION | Email: CollsCustomerFeedback@hlbb.hongleong.com.my Contact Number: +603-7626 8899 |

| REPAYMENT CHANNELS | Hong Leong Connect, interbank GIRO (MEPS IBG), standing instruction facility (CASA auto-debit), ATM, CDM, any Hong Leong Bank branch |

| ELIGIBILITY | Minimum Monthly Salary: RM2,000 Minimum Annual Income: RM24,000 Minimum Age: 21 Maximum Age: 70 Guarantor requirement: Applicants who do not meet the minimum annual income or foreigners |

Not sure whether to get a fixed-rate or variable rate for your loan? You can check all the details that you need before deciding when you go with the Hong Leong auto loan.

They provide a simple side-by-side comparison of their fixed and variable rates that shows details for term charges, installment, late payment interest, early loan settlement. This means that you can easily see which works better for you right from the get-go.

If you’re an individual applicant, all you need is your NRIC, driving license, latest 3 month’s salary slips, and a couple of forms—that’s it. And as long as you’re between 21 to 70 years of age, applying for this loan should be a cinch.

With minimal requirements and a financial plan that caters to new, used, and reconditioned vehicles, you should consider their loan if you want hassle-free processing. As soon as you book an appointment online, they’ll give you a call at your preferred time, you can submit your requirements afterward and then wait for your loan approval.

Pros

- On-site loan calculator

- Online appointment available

- No penalty fee on early settlement

Cons

- Limited loan packages

- No Islamic auto loan package

4. CIMB Car Loans

| WEBSITE | cimb.com.my |

| SERVICES | Car loans |

| ADDRESS | 11, Jln Raja Laut, Kuala Lumpur City Centre, 50350 Kuala Lumpur, Federal Territory of Kuala Lumpur, Malaysia |

| CONTACT INFORMATION | Email: cru@cimb.com Contact Number: +603-6204 7788 |

| ELIGIBILITY | Minimum Monthly Salary: RM2,000 Minimum Annual Income: RM24,000 Minimum Age: 18 Maximum Age: 70 Guarantor requirement: Parents or siblings, local guarantor for foreigners |

Are you tired of all the fuss and complexities that come with auto loans? CIMB offers a straightforward approach to loans you’ll instantly notice when you visit their website.

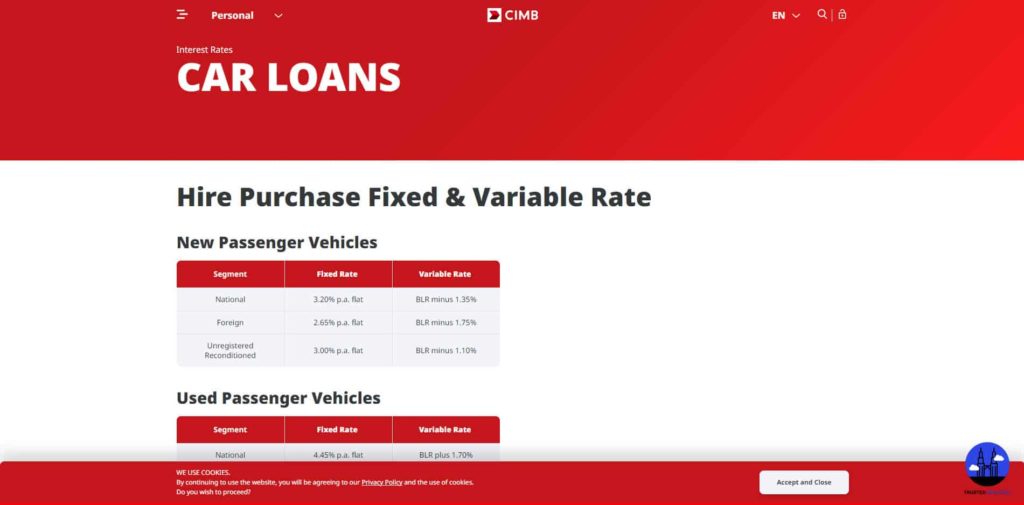

You can cut through the case and easily view the fixed and variable rates for passenger and commercial vehicles. Whether you’re looking for new or old vehicles, they’ve organized everything according to vehicle segment so you can easily check the rates for your ideal vehicle.

If you plan on getting a fixed rate hire purchase loan, a 7-year repayment plan will generally have a 3.20% interest rate and an RM525 monthly rate. This should be one of the most affordable rates that you can get in the country.

Their website has limited information about their car loan packages so you’ll have to contact a branch nearest to you. Luckily, you can easily navigate to their contact page where you can search for your preferred branch and gather the contact details that you need.

Pros

- Low interest rates

- Online inquiry available

- Separate packages for used or new passenger and commercial vehicles

Cons

- No payment option details

- No online loan application

- You need to contact them directly for more details

5. Bank Muamalat Vehicle Financing

| WEBSITE | muamalat.com.my |

| SERVICES | Auto-Grad Scheme, Government Scheme, Structured Vehicle Financing-i, Vehicle Financing-i |

| ADDRESS | Ibu Pejabat, Menara Bumiputra, 21 Jalan Melaka, 50100 Kuala Lumpur |

| CONTACT INFORMATION | Email: feedback@muamalat.com Contact Number: +603-2600 5500 |

| ELIGIBILITY | Minimum Monthly Salary: RM2,300 Minimum Annual Income: 27,600 Minimum Age: 18 – 20 (depending on loan package) Maximum Age: 44 – 70 (depending on loan package) |

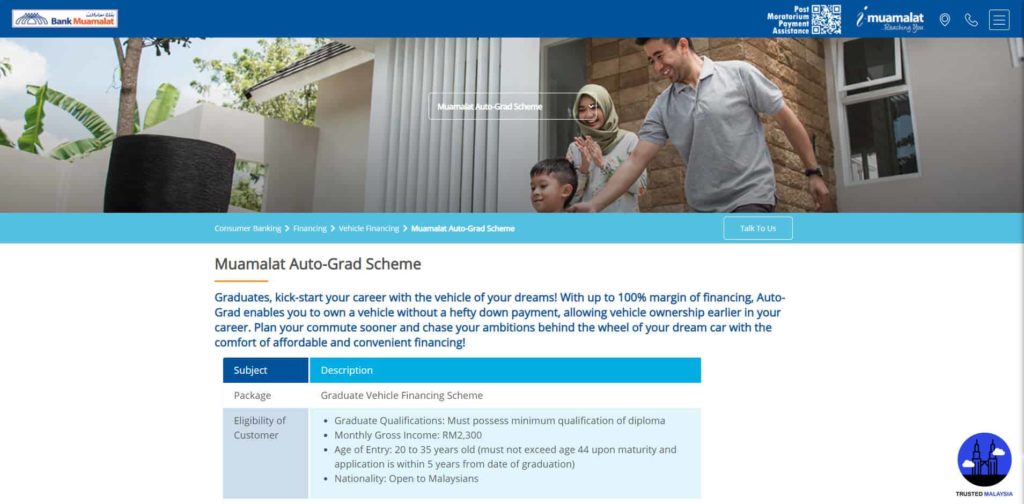

If you’re looking for specific loan packages that fit your needs, you should check out the vehicle financing options that Bank Muamalat offers.

If you’re a fresh graduate, they have an Auto-Grad Scheme that can help you start your career with the car of your choice. They offer up to 100% margin of financing that you can easily apply for as long as you’re a local, have an RM2,300 monthly income, and are 20 to 35 years old.

Government servants also have it with their Government Scheme that has 100% margin of financing and is open to individuals as young as 18 years old. They offer secure fixed rates and minimal document requirements so you can expect quick and hassle-free applications.

They also provide special loan packages for retiring government servants and military personnel. You only need at least RM1,800 monthly income which is one of the lowest income requirements you can find in Malaysia.

Though they generally have a high monthly income requirement, their diverse auto loan options allow you to choose the best plan for you. Additionally, we highly recommend their loan plans for Malaysian armed forces and retiring government employees because of their fixed-rate and minimal requirements.

Pros

- Multiple auto loan packages

- Online loan application and inquiry available

- Low monthly requirement for retiring government servants and military personnel

Cons

- Most plans require a high annual income

- No variable rate option

- No details for repayment options

- Most loan packages are exclusive for locals

FAQs About the Best Car Loan in Malaysia

As long as you know where to start looking, finding the best car loan in Malaysia doesn’t have to be as complicated as you think. You can start your search by checking out the plans that you’re eligible for and then work your way from there.

Did this article help you find the best car loan in Malaysia? If so, we’d love to listen to your experience by sending us a message.

Are you planning to start your very own business? You don’t have to worry about your capital when you check our recommendations for the best business loans in Malaysia.